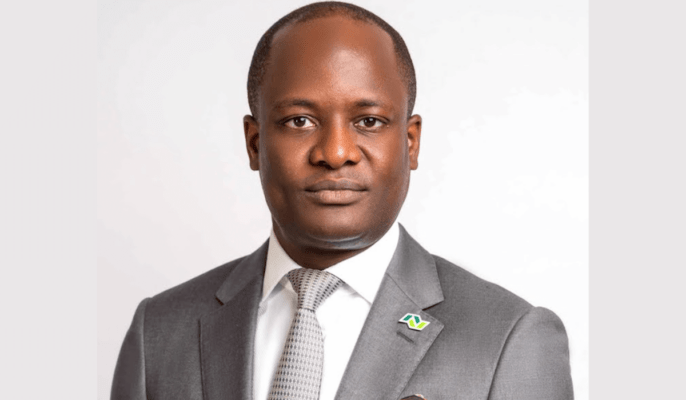

Nigerian Exchange Group (NGX Group) recently took a significant step towards revolutionising Nigeria’s capital market with the launch of its innovative e-offering platform, NGX Invest. The platform comes at a crucial time as the banking sector undergoes recapitalisation. Temi Popoola, Group Managing Director/Chief Executive Officer of NGX Group, in this interview, provides valuable insights into this digital transformation initiative which is designed to streamline primary market issuance processes, writes Iheanyi Nwachukwu. Excerpts

NGX Group has provided the market with a new horizon, NGX Invest, what is there to know about the new platform?

NGX Invest is an innovative e-offering platform introduced by Nigerian Exchange Group Plc to streamline the distribution of securities in the primary market, making it more accessible to a broader range of investors. With NGX Invest, investors can participate in primary market transactions with just a few clicks, similar to the ease of transferring money via mobile phones. Accessible from https://invest.ngxgroup.com the platform offers a user-friendly interface that allows investors to easily onboard and verify their identities through the Nigeria Inter-Bank Settlement System (NIBSS) using their Bank Verification Number (BVN). This enables them to securely create and access brokerage accounts without the need for cumbersome paperwork or physical presence. It significantly reduces the time and complexity traditionally associated with investment processes. NGX Invest also allows banks to integrate their channels as payment gateways for seamless transfers.

It builds on NGX Group’s strong history of technological innovation, particularly in market infrastructure and architecture, which was evident during the COVID-19 pandemic when the Exchange operated remotely for nearly three years without interruption.

Leveraging the success of the country’s first digital public offering in 2021, we have worked within the regulatory framework to ensure compliance in the development and operationalization of NGX Invest. The development of NGX Invest was a collaborative effort involving unwavering support from our Board, the Securities and Exchange Commission (SEC), the Central Bank of Nigeria (CBN), Central Securities Clearing System (CSCS) Plc, Nigeria Inter-Bank Settlement Systems PLC, and our valued capital market partners. Through this collaboration, we have streamlined primary market issuances and processes, particularly in capital raising. We are grateful for the support throughout this journey.

NGX Invest represents a significant step forward in the digital transformation of Nigeria’s capital markets. It embodies NGX Group’s commitment to leveraging technology to enhance market accessibility, efficiency, and transparency, thereby driving greater participation and investment in the Nigerian economy.

How will NGX Invest enhance ease of investing, liquidity, transparency, and market integrity?

NGX Invest democratizes investing by providing a user-friendly interface accessible to all, including young Nigerians who have been historically underrepresented in the market. By simplifying the investment process, NGX Invest removes traditional barriers to entry and promotes broader financial inclusion. The platform’s innovative approach facilitates seamless connections between banks and capital markets, leveraging the banking recapitalization process to integrate APIs into distribution pathways. This integration has the potential to significantly increase capital flow and market liquidity. Additionally, its advanced digital infrastructure ensures real-time verification and monitoring of transactions. This heightened transparency, coupled with strict adherence to Securities and Exchange Commission (SEC) regulations, ensures a secure and compliant investment environment.

What is the long-term vision of NGX Invest in attracting the young generation to the capital market for economic growth and wealth creation in Nigeria?

We acknowledge the complexity of financial markets and recognize that there is no single solution to increasing retail investor participation. NGX Invest is designed to address some of these challenges by simplifying access to the capital market for young investors. However, many potential young investors are not fully aware of the opportunities available to them. As part of our long-term vision, we are committed to enhancing financial literacy through targeted educational initiatives. Additionally, we are focused on diversifying the range of products and asset classes available. By offering a wider variety of investment options, we aim to cater to the diverse interests and risk appetites of young investors, thereby encouraging their sustained participation in the capital market.

How does NGX Invest integrate with and complement existing financial infrastructure, including brokerage firms and banking institutions?

NGX Invest is designed for inclusivity, allowing intermediaries to effortlessly integrate the platform into their existing systems. It supports both modern and traditional investment strategies, enabling a smooth transition from paper-based methods. The platform’s bulk order upload feature enhances accessibility and efficiency. NGX Invest integrates with brokerage firms and banks through APIs, connecting with the Central Securities Clearing System (CSCS) for brokerage information and the Nigeria Inter-Bank Settlement System (NIBSS for verification, while supporting multiple payment gateways. This ensures a smooth flow of capital between investors and financial markets, improving overall market efficiency and accessibility.

The platform currently supports investments in the primary market, are there plans to expand it into the secondary market?

The simple answer is no. NGX Invest focuses exclusively on primary market offerings, aligning with our regulatory environment and operating under stringent frameworks. Our regulator has specifically approved NGX Invest to support primary market issuances, reflecting our core objective of streamlining the distribution of securities in the primary market and attracting a wider range of retail investors to the capital market. At NGX Group, we are committed to leveraging technology to enhance our market infrastructure. As we move forward, we will continue to expand NGX Invest’s capabilities, focusing on the electronic distribution of retail-suitable asset classes in the primary market. This approach allows us to progressively broaden our offerings while adhering to regulatory guidelines and prioritizing retail investor engagement.

With the primary market being digitised, one would expect that the share allotment will be seamless. Is that an expectation?

Absolutely. Beyond seamless share allotment, digitization also streamlines the dividend distribution process. In a traditional paper offering, additional follow-up work is required. However, with a digital platform, investors can designate any account as their dividend account. Identity verification is performed in real time by NIBSS, and this information is then sent to the registrar, significantly simplifying the dividend payment procedure. Moreover, with the integration of BVN and the designated dividend account, there is potential for dividends from other shares linked to the same BVN to be aggregated and consolidated for payment. This approach enhances overall efficiency and convenience for investors.

Was NGX Invest specifically designed for the ongoing capital raises by Nigerian banks, and is it accessible to a global audience?

The timing is coincidental. NGX Invest is not exclusively designed for the ongoing capital raises by Nigerian banks; it is a solution for any primary market issuance. However, the banks are currently the primary issuers utilizing this platform. Our objective is to harness cutting-edge technology to revolutionize the primary market, attract a larger base of retail investors, and create a more efficient and dynamic market environment.

While NGX Invest is technologically capable of supporting investments from a global audience, regulatory constraints currently limit its accessibility within the legal framework of the Nigerian market. The platform focuses on compliance with domestic regulations but has the potential for broader application in the future. This compliance ensures the platform’s robustness and its ability to support innovative capital-raising initiatives within the country, thereby promoting confidence and transparency in the market.

Culled from BusinessDay